Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Year

Forecast Year

Value in AUD billion

2026-2035

Australia Courier, Express, and Parcel Market Outlook

*this image is indicative*

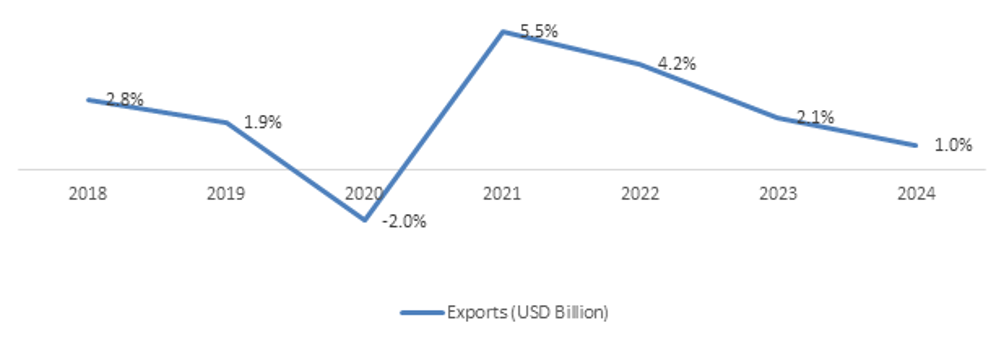

Australia’s economic freedom score stands at 76.2, positioning its economy as the 13th freest globally in the 2024 Index of Economic Freedom. This represents an improvement of 1.4 points from the previous year. In the Asia-Pacific region, Australia ranks 4th out of 39 countries.

Australia is internationally competitive in key sectors such as technology, and high-value-added manufacturing, offering potential opportunities in Australia courier, express, and parcel market.

Australia has established free-trade agreements with the United States, China, Japan, South Korea, the Association of Southeast Asian Nations (ASEAN), and the United Kingdom that facilitates the parcel and courier services.

Figure: Annual Growth in Gross Domestic Product, Chain Volume Measures, 2018-2024, Annual Growth (%)

In the e-commerce sector, parcel, express, and courier services efficiently manage order deliveries during peak demand and manage customs, duties, and taxes in international shipping.

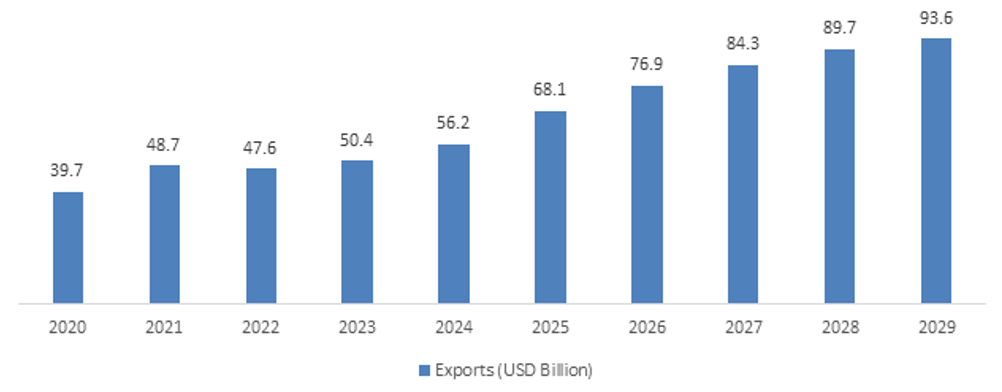

Figure: Australian E-commerce Revenue (AUD Billion), 2020-2029 (E)

As per the Australia courier, express, and parcel (CEP) market analysis, in 2022, the top 5 e-commerce sites by revenue in Australia, including Woolworths, Coles, Apple, JB HiFi, and Officeworks, accounted for 30.2% of total domestic e-commerce.

In 2023, on average 5.6 million households in Australia made an online purchase each month. According to Australia Post’s 2024 eCommerce insights, online consumers in Australia spent roughly AUD 95.8 billion on eCommerce products and checked out an average basket size of AUD 147.7.

The growth in businesses can expedite the courier, express, and parcel services by efficiently and reliably delivering goods to customers quickly, offering customer satisfaction. By 2031, Australia is projected to have 3.5 million new businesses, driving potential demand for CEP services. This can also improve Australia courier, express and parcel (CEP) market revenue.

The growing e-commerce industry is driving demand for courier, express and parcel (CEP) services in Australia. According to the 2022 report of the Australian Bureau of Statistics (ABS), the percentage contribution of e-commerce- wholesale in digital activity value increased to 19.7% in 2020-21 from 19.2% in 2019-2020. In 2023, 5.6 million households made online purchases each month, with over 80% of Australian households (9.5 million, +1.4% YoY) receiving a parcel in the same year.)

Growing adoption of advance digital technologies in logistic sector in Australia is further expected to boost the growth of the Australia courier, express and parcel (CEP) market in the coming years. For example, in 2022, DHL Supply Chain announced an investment of AUD 150 million over the next two years in automation and robotics at its Australian warehouses. This includes commissioning 1,000 new assisted picking robots by 2025. Similarly, in September 2024, the Australia Post launched a new five-member panel of technology service providers to support its delivery of industry-leading digital experiences.

| Australia Courier, Express, and Parcel (CEP) Market Report Summary | Description | Value |

| Base Year | AUD billion | 2025 |

| Historical Period | AUD billion | 2019-2025 |

| Forecast Period | AUD billion | 2026-2035 |

| Market Size 2025 | AUD billion | 19.87 |

| Market Size 2035 | AUD billion | 33.94 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.50% |

| CAGR 2026-2035 - Market by Region | Australian Capital Territory | 5.6% |

| CAGR 2026-2035 - Market by Region | Western Australia | 5.4% |

| CAGR 2026-2035 - Market by Destination | Domestic | 5.3% |

| CAGR 2026-2035 - Market by Business | B2C (Business-to-Consumer) | 5.7% |

| 2025 Market Share by Region | Western Australia | 16.4% |

Growing trend of sustainability

There is a growing inclination towards sustainable practices in courier, express and parcel services in Australia, amidst the rising concerns of environment safety and pollution. Australia Post is actively engaged in minimising the environmental impact of its packaging. Australia Post has membership in the Australian Packaging Covenant Organisation (APCO) and aligns with the 2025 National Packaging Targets. The introduction of Sustainable Packaging Principles prioritises the use of recycled materials, the adoption of the Australasian Recycling Label (ARL), and the recyclability of packaging, addressing evolving consumer and regulatory expectations.

Integration of new technologies contributing to market growth

With the growing demands of customers and expansion of e-commerce, new technologies are being integrated to streamline parcel delivery operations. State-of-the-art technologies such as automated sorting systems, capable of handling a diverse range of parcel size, drones and autonomous vehicles equipped with advanced tracking technologies are gaining traction in Australia courier, express and parcel (CEP) market. These techniques create transparency that enhances customer experience by keeping them informed throughout the delivery process.

The strategic location of Australia supports international courier services

Australia, which lies between the Pacific and Indian Oceans is advantaged by the proximity to other Asia Pacific countries such as China, Singapore, Japan, and South Korea. The strategic location reduces logistical challenges and shipping times in international courier services that significantly support inbound international parcels.

Australia has the presence of robust logistics infrastructure

Australia has a well-established logistics infrastructure which encompasses rail, maritime, airways and roadways. Road transportation is considered the major form of freight transportation in Australia, constituting to about 80%. The government of Australia has laid of several initiatives and plans to strengthen the logistics system in the country, such as The National Freight and Supply Chain Strategy, Supply Chain Resilience Initiative, further pushing the Australia courier, express and parcel (CEP) market expansion.

Investment in infrastructure development is expected to facilitate logistics activities. In the 2024-25 budget, the Australian government has committed AUD 120 billion for land transport infrastructure projects.

CEP service providers are incorporating electric fleets into their delivery services to gain consumer attention by achieving sustainability criteria. In 2024, Australia Post incorporated 5,131 units of electric fleets.

Australia Courier, Express and Parcel (CEP) Market Opportunities

Parcel, express and courier services help in global shipping by managing customs, duties, and taxes. In domestic e-commerce, such services can manage peak demand fluctuations. In 2022, 28% of Australians purchased products from international sellers, and in 2024, 17.08 million Australian shoppers used online shopping websites monthly, a 45% increase from 2020.

As per the Australia courier, express and parcel (CEP) market report, the incorporation of drone technology, tracking of goods in transit through RFID tags, barcodes and QR codes, and artificial intelligence improve operational efficiency. Additionally, the adoption of route optimisation technology automatically integrates its location into the optimal route.

Parcel lockers are gaining popularity as alternative delivery methods to avoid missed deliveries. In 2024, Australia Post operated a network of 773 parcel locker locations with 24/7 operations and witnessed a 32% year-over-year increase in parcel locker deliveries.

Australia Courier, Express and Parcel (CEP) Market Restraints

Letters can serve as a substitute for Australia parcel and courier services for small, lightweight items. Letters are a budget-friendly option for sending documents and personal messages. Post services in Australia are including regular, priority, and express post services, including postcards and seasonal greeting cards.

Economic uncertainties and geopolitical risks can reduce international trade due to fluctuating exchange rates and sovereign risk. Such a scenario can reduce the export and import of goods, thus impacting the Australia courier, express and parcel (CEP) market dynamics and trends. Additionally, economic downturns can impact the price of fuel, which consists of about 30% to 50% of the total freight cost.

The EMR’s report titled “Australia Courier, Express, and Parcel (CEP) Market Report 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Destination

Market Breakup by Business

Market Breakup by Mode of Transportation

Market Breakup by End Use

Market Breakup by Region

Market Insights by Destination

Demand for domestic CEP services is rising: With more people moving to urban areas, the demand for fast and flexible last-mile delivery services continues to rise. CEP providers are enhancing their urban logistics networks to meet these expectations.

Australia's urban population grew by 2.55% in 2023 compared to 2022, reaching 23,073,508. Alongside this, increased spending on online shopping is driving domestic courier, express and parcel (CEP) demand in Australia.

The companies are investing significantly to tap into the growing opportunity. For instance, in June 2023, Bailey Nelson partnered with B dynamic logistics to support the expansion and growth of its operation across Australia. Furthermore, in September 2023, FedEx Express announced new automated e-commerce capability to support small businesses and e-commerce merchants in Australia.

Market Insights by Business

Australia courier, express and parcel (CEP) market is witnessing significant growth across B2B, B2C, and C2C channels, driven by the increasing reliance on e-commerce.

In August 2024, IKEA signed a three-year contract with Australia Post for parcel delivery services. The deal covers 65% of IKEA's online sales, with Australia Post committing to deliver over 250,000 parcels annually. The collaboration enhances IKEA's delivery capabilities across Australia, including remote areas, offering both Parcel Post and Express Post options along with click-and-collect services through local post offices.

Furthermore, the transport, postal, and warehousing sectors contributed AUD 29,058 million to the national economy in 2023-2024, reflecting consistent growth. As per the Australian Retailers Association, one-third of the total spent is expected to be spent online by 2032. This growth is expected to support the growth of the CEP services in the country.

Market Insights by Transportation

Australia's 427,000 km paved road network plays a vital role in supporting the Australia courier, express and parcel (CEP) market development. According to BITRE, road logistics is expected to increase by 77% between 2020 and 2050, reaching 394 billion ton-kilometers, fueled by growing interstate and urban freight demands. Interstate logistics is projected to expand at an annual rate of 2.9%, while urban logistics is anticipated to grow by 2.2% annually, highlighting the ongoing importance of road transport for CEP services.

Air transportation is playing a key role in strengthening the Australia courier, express and parcel (CEP) market by facilitating faster international and domestic deliveries to meet the growing demands of e-commerce and consumer expectations for quicker shipping. In October 2024, Australia Post added two additional Airbus A321P2F in partnership with Qantas, that will operate between the east coast, Perth, Tasmania and Cairns, carrying around 21,000 parcels each.

Market Insights by End Use

The expanding e-commerce sector has greatly driven the rise in online shopping in Australia. According to the Australian Bureau of Statistics (ABS), in the 2021-22 period, the contribution of digital activity GVA for retail and wholesale trade accounted for 11% and 21.2% respectively. Further, in 2022, Australians spent AUD 63.8 billion on online goods, a 1.7% increase from 2021, pushing the online share of total retail spending to 18.1%.

Expanding manufacturing sector and growing international trade activities are also driving Australia courier, express and parcel (CEP) market. In 2023, the manufacturing industry contributed AUD 44.43 billion of value-add to the Australian economy in 2023 and posted a 2.8% real growth rate. A significant volume of parcels is imported and exported across Australia's borders. It ranks as the fifth-largest global user of shipping services, with 10% of the world’s sea trade passing through its ports.

New South Wales Courier, Express and Parcel (CEP) Market Opportunities

Companies are investing in opening new parcel facilities to meet the growing demand for parcel volume. In August 2024, FedEx Australia opened a 2,400 square-metre state-of-the-art sortation and distribution facility in Coffs Harbour, New South Wales, designed to support SMEs expanding their e-commerce reach. The facility can sort up to 1,300 parcels per hour, thus supporting the Australia courier, express and parcel (CEP) market.

In June 2023, Australia Post opened its newest parcel facility in Kemps Creek, New South Wales. The 33,680 square-metre facility is the second largest sorting facility in Australia Post’s network with daily capacity of 200,000 large and small parcels.

| CAGR 2026-2035 - Market by | Region |

| Australian Capital Territory | 5.6% |

| Western Australia | 5.4% |

| New South Wales | 4.6% |

| Victoria | XX% |

| Queensland | XX% |

| Others | XX% |

Victoria Courier, Express and Parcel (CEP) Market Dynamics

The Victorian Government has significantly invested in projects across Victoria under its Victorian Freight Plan 2018–2050 to support the efficient movement of freight, including the Murray Basin Rail Project, the Freight-Passenger Rail Separation Project, the M80 Upgrade, the West Gate Tunnel, the Port Rail Shuttle Network, bridge strengthening and regional freight route upgrades.

In 2023, the freight and logistics sector contributed AUD 21 billion to Victoria’s economy and freight volumes are predicted to increase in Victoria from around 360 million tonnes in 2014 to nearly 900 million tonnes in 2051.

Queensland Courier, Express and Parcel (CEP) Market Trends

According to the 2024 report by Australia Post, Queensland's online purchases increased by 4.3% year-over-year in 2023, positioning it among the top-performing states in the country.

To tap into the growing opportunity, Australia Post announced an investment of over AUD 75.8million in March 2024 in setting up a new parcel facility at Brisbane Airport, which is set to process 176,000 parcels daily by early 2026. This will increase overall Australia courier, express and parcel (CEP) market share.

Australian Capital Territory Courier, Express and Parcel (CEP) Market Insights

Increase in retail spending and online shopping is anticipated to drive the Australia courier, express and parcel (CEP) market. According to the 2024 report by the Australian Bureau of Statistics, the retail trade in Australian Ca pital Territory rose from AUD 670 million in July 2023 to AUD 680 million in July 2024, thus registering an annual growth of 1.5%.

Further, Australian Capital Territory ranked seventh in retail spending in 2023 with retail spending in the June quarter of 2023 being 14% higher than the decade average.

Western Australia Courier, Express and Parcel (CEP) Market Drivers

To meet the increasing parcel volume demand, companies are expanding their facilities. CouriersPlease opened a new Perth facility in July 2024 that is expected to handle over four million parcels annually.

Similarly, to meet the growing need of e-commerce in Western Australia, Australia Post (AusPost), an Australian Government-owned corporation that provides postal services, opened an AUD 82 million parcel processing facility in Perth, Western Australia in 2022.

Players in the Australia courier, express and parcel (CEP) market are deploying technology, such as RFID tags, barcodes, and QR codes to provide customers the ability to track the package. This also helps the companies prevent theft or loss and enhances customer satisfaction.

DHL EXPRESS (AUSTRALIA) PTY LTD.: Founded in 1969, DHL Group is home to two renowned brands, DHL and Deutsche Post. Its international service portfolio encompasses mail and parcel delivery, express services, freight transport, supply chain management, and e-commerce logistics solutions. The Group is organised into five operating divisions: Express; Global Forwarding, Freight; Supply Chain; eCommerce; and Post & Parcel Germany.

Federal Express (Australia) Pty Limited: FedEx offers fast and reliable delivery services to over 220 countries and territories. In Australia courier, express and parcel (CEP) market, the company maintains a strong presence with 42 operational offices. In 2016, FedEx expanded its global presence by acquiring Dutch-owned TNT Express. TNT originally commenced operations in Australia in 1946, while FedEx established its operations in the country in 1989.

Australia Post Group: Founded in 1809, Australia Post operates a vast network with 12.7 million delivery points, supported by 4,198 post offices, including 2,553 located outside major cities and 3,520 licensed post offices and community postal agents. The network also includes 773 parcel locker banks, over 14,000 street posting boxes, and 5,131 electric delivery vehicles and bicycles, ensuring efficient and sustainable operations.

Couriers Please Pty Limited: Founded in 1983, CouriersPlease is a franchised courier and parcel delivery service company, specialising in meeting the diverse shipping needs of e-commerce retailers and traders across the nation. The company is fully owned by Singapore Post (SingPost). Its extensive network is powered by independent Franchise Partners and network affiliates, ensuring reliable and efficient delivery services.

Other players included in the Australia courier, express and parcel (CEP) market are Direct Couriers Pty Ltd., Allied Express Transport, Kings Transport (VIC) Pty Ltd., Aramex Australia, and Toll Holding Limited.

Technological advances and sustainable trends are driving the Australia courier, express and parcel (CEP) market growth.

December 2024

DHL Supply Chain Australia (DHL) announced the groundbreaking of its advanced Transport Hub in Derrimut, Victoria. Scheduled for completion in June 2025, the facility will support the growth of DHL’s Transport sector, adding 16,600m² of warehouse and office space.

November 2024

Toll Group expanded its contract logistics and supply chain solutions across Australia with the addition of new warehousing in Auckland. This 10,000 sqm multi-user facility supports multinational customers in the retail, fashion, and consumer sectors, enhancing Toll's regional presence and strengthening its inbound 3PL warehousing and shipping capabilities.

August 2024

FedEx Australia opened a new 2,400m² state-of-the-art sortation and distribution facility in Coffs Harbour, New South Wales. The facility was designed to support small and medium-sized enterprises (SMEs) in expanding their domestic and international e-commerce operations.

March 2024

Sendle, an Australian courier service for small businesses, expanded its international shipping network by 40%, allowing more small businesses to reach customers in over 220 countries. Additionally, 865 new pick-up suburbs across Australia were made available for international shipping, leading to Australia courier, express and parcel (CEP) market development.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us today for customized, data-driven solutions tailored to your unique requirements!

In 2025, the market reached an approximate value of AUD 19.87 billion.

The Australia courier, express and parcel (CEP) market is assessed to grow at a CAGR of 5.50% between 2026 and 2035.

The Australia courier, express and parcel (CEP) market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around AUD 33.94 billion by 2035.

The major drivers of the market are the rapid growth of e-commerce, increasing consumer demand for reliable delivery services, and the globalisation of trade necessitating efficient cross-border shipping solutions.

Key trends in the Australia courier, express and parcel (CEP) market include rising demand for fast delivery services, technological advancements such as AI and tracking systems, and an increasing focus on sustainability initiatives.

The major regions in the market include New South Wales, Victoria, Queensland, Australian Capital Territory, and Western Australia, among others.

The various modes of transportation considered in the market report are roadways, railways, and waterways and airways.

The various destinations considered in the market report are domestic and international.

The various end use sectors considered in the market report are retail, healthcare, industrial manufacturing, and financial institutions, among others.

The major players in the industry are DHL EXPRESS (AUSTRALIA) PTY LTD., Federal Express (Australia) Pty Limited, Australia Post Group, Couriers Please Pty Limited, Direct Couriers Pty Ltd., Allied Express Transport, Kings Transport (VIC) Pty Ltd., Aramex Australia, and Toll Holding Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| Report Features | Details |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Destination |

|

| Breakup by Business |

|

| Breakup by Mode of Transportation |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Choose the right license for your needs and access rights.

Add the report to your cart with one click and proceed to register.

Choose a payment option for a secure checkout. You will be redirected accordingly.

Pricing Plans

One User

Five Users

Unlimited Users

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

We ensure that you get unmatchable competitive advantage by providing detailed insights about the existing market scenario as well as the emerging and high growth markets.

Regions and Countries with the Highest Number of Returning Clients

Projects delivered with customization

Projects involving industry specific expertise

Analysts Support

Corporates choose us as their preferred partner

Commitment to Excellence

Diverse Teams

Innovative Solutions

Client Centric Approach

Continuous Improvement

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61 448 06 17 27

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-120-433-0800

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63 287899028, +63 967 048 3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84865399124