Article

Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Allianz Australia Limited, Zurich Financial Services Australia Ltd., nib Travel Services (Australia) Pty Ltd., Fast Cover Pty Ltd, AIG Australia Limited, 1Cover Pty Ltd., Australia Post Group, American Express Company, among others, are the key players in the Australia travel insurance market.

The Australia travel insurance market, valued at AUD 11.03 billion in 2024. The market is forecasted to grow at a compound annual growth rate (CAGR) of 4.10% from 2025 to 2034, potentially reaching AUD 16.48 billion by 2034.

Travel insurance is designed to cover various risks and financial losses that may occur while travelling, protecting against unforeseen events that can disrupt or impact travel plans. It covers the cost of medical treatment if individuals get sick or injured while travelling. Additionally, it reimburses prepaid, non-refundable expenses if individuals cancel their trip for a covered reason such as illness, injury, death of a family member, or severe weather.

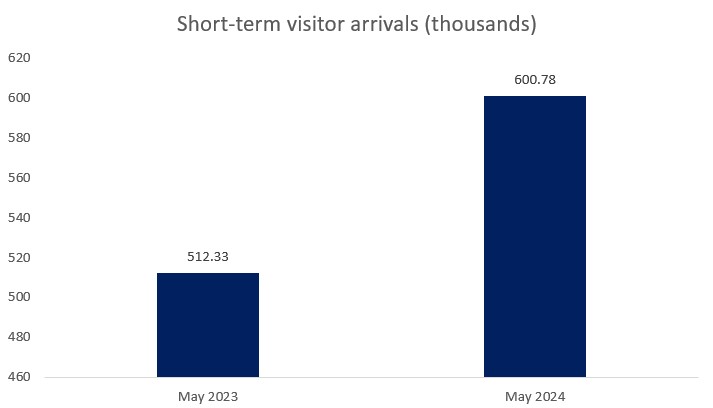

Most travel insurance policies include access to 24/7 assistance with medical, legal, and travel-related emergencies, and some policies offer concierge services to help with reservations, bookings, and other travel arrangements. Companies and insurers also provide tailored policies to meet specific needs including coverage of activities like adventure sports, business travel, or family vacations. According to the Australian Bureau of Statistics, short-term visitor arrivals in Australia increased to 600.78 thousand in May 2024, up from 512.33 thousand in May 2023.

Increasingly individuals travel domestically and internationally, and the likelihood of incidents such as trip cancellations, medical emergencies, and lost luggage rises fuelling the Australia travel insurance market growth. Higher travel expenditures on flights, accommodations, and activities increase the financial risks associated with travel disruptions. Travellers carrying high-value items like expensive electronics are more inclined to seek comprehensive insurance policies to protect their investments.

Single-trip travel insurance is boosting the Australia travel insurance market by catering to the needs of occasional travellers seeking specific coverage for individual trips. It offers convenience and affordability appealing to a wide range of travellers, including vacationers and business travellers, driving market demand. The flexibility of these policies allows insurers to tailor coverage to the unique needs of each trip.

Fast Cover, an Australian travel insurance provider, is addressing increased customer demand with flexible, award-winning, and customer-focused products. Their intuitive online platform allows Australian travellers to quickly obtain quotes and purchase insurance. As Lloyd's cover holder, Fast Cover demonstrates a commitment to innovation and excellent customer service, revolutionizing how Australians think about and buy travel insurance.

| Global Headquarters | Germany |

| Establishment | 1890 |

| Website | www.allianz.com.au |

Allianz Australia Ltd., a subsidiary of the global Allianz Group, employs around 5,500 staff and offers diverse insurance services. These include personal insurance for life, home, travel, roadside assistance, and boats. Additionally, Allianz Australia provides small business insurance, workers' compensation, and financing services, positioning itself as a comprehensive provider within the insurance and financial services sectors. It focuses on sustainability and addressing environmental, social, and governance (ESG) issues.

| Global Headquarters | Switzerland |

| Establishment | 1872 |

| Website | www.zurich.com.au |

Zurich Financial Services Australia Ltd. offers diverse insurance and financial services, including life, marine, motor insurance, security protection, critical illness cover, and retirement income planning. With approximately 55,000 employees, Zurich Group operates in over 215 countries, providing property, casualty, and life insurance products. Serving individuals, small businesses, mid-sized and large companies, and multinational corporations, Zurich supports a broad range of customer needs worldwide.

| Global Headquarters | Australia |

| Establishment | 1952 |

| Website | www.nibtravelinsurance.com.au |

nib Travel Services (Australia) Pty Ltd is Australia’s third-largest travel insurer, offering global coverage through nib Travel to protect and assure travellers worldwide. The company addresses social, economic, and environmental factors, aligning them with its purpose. Trusted by 1.7 million, nib provides health and medical insurance to over 1.5 million residents in Australia and New Zealand, and covers more than 180,000 international students and workers in Australia.

| Global Headquarters | Australia |

| Establishment | 2010 |

| Website | www.fastcover.com.au |

Fast Cover Pty Ltd specialises in travel insurance with a consumer-centric approach, prioritising travellers' needs. By simplifying the insurance purchasing process, Fast Cover offers quality, easy-to-understand coverage that aligns with travellers' needs. The company ensures that its products meet market requirements through a robust review process, maintaining relevance and appropriateness throughout their lifecycle. Fast Cover's vision is to transform the travel insurance experience with efficiency and clarity.

| Global Headquarters | United States |

| Establishment | 1919 |

| Website | www.aig.com.au |

AIG Australia, a general insurer within the American International Group, Inc., offers property casualty, personal, and business insurance, including travel and accident solutions. With offices in Melbourne, Sydney, Perth, and Brisbane, AIG Australia delivers exceptional service and expertise across Australia. AIG Global, its parent company, reported total assets of US$539 billion in 2023 and serves approximately 190 countries and jurisdictions.

| Global Headquarters | Australia |

| Establishment | 2003 |

| Website | www.1cover.com.au |

1Cover, Australia's leading travel insurer with over 20 years of experience, transformed the online travel insurance market. We have safeguarded over 2 million Australians and New Zealanders, offering 24/7 world-class emergency assistance. Our team provides medical services globally and ensures prompt evacuation to the nearest medical facility if needed. With 1Cover, travellers can rely on exceptional support and care wherever they are.

| Global Headquarters | Australia |

| Establishment | 1809 |

| Website | www.auspost.com.au |

Australia Post operates in letters and services, agency services and retail merchandise, and parcels and logistics both domestically and internationally. Central to Australian communities, our Post Offices serve as crucial local hubs. It partners with organizations like Beyond Blue, the Australian Red Cross, and the Indigenous Literacy Foundation to enhance mental health, support disaster recovery, and improve children’s literacy, helping communities thrive.

| Global Headquarters | United States |

| Establishment | 1850 |

| Website | www.americanexpress.com/en-au/ |

American Express Company, a leading financial corporation, specializes in issuing credit cards, processing payments and offering travel-related services globally. Its enterprise ESG strategy and Community Giving, driven by the American Express Foundation, leverage our resources to support customers, colleagues, and communities. They are committed to making a positive impact through our extensive financial services and community-focused initiatives.

| CAGR 2024-2032 - Market by | In Terms of USD Billion |

| Market Size 2023 | 578 |

| Market Size 2023 | 578 |

| Market Size 2023 | 578 |

Latest Updates on Thriving Economically in a World of Constant Innovation

To place an order through our website, select the license type mentioned on the report details page. Click on the ‘Buy Now’ button and fill in your details. Select your preferred mode of payment after which you will be redirected to the selected payment gateway. Follow the steps and proceed to checkout.

www.expertmarketresearch.com.au

Enlisting all your requirements and queries along with details that include billing and delivery address and the preferred payment mode. Our customer service representative will revert to you within 24 hours.

[email protected]

To place an order through telephone, call our sales team on the following numbers and our customer service representative will help you regarding the same.

+61 291 889 415United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61 448 06 17 27

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-120-433-0800

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63 287899028, +63 967 048 3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84865399124